Thought of the Week - Analysts should pay more attention to macro forecasts

By Joachim Klement, Head of Strategy

As a strategist who uses macroeconomic and other ‘big picture’ data to assess the fortunes of stock markets, I would obviously argue that investors ignore the macroeconomic environment at their peril. Unbiased as I am in this matter, I have chosen to discuss today a study by economists at the Federal Reserve (who are surely just as unbiased as I) that shows analysts can improve their earnings forecasts by paying more attention to macro forecasts.

Equity analysts are experts in the companies they cover. They know every detail about a firm’s operations, finances, and corporate strategy. But often they lose the forest for the trees, paying little to no attention to the overall environment in which these companies operate. But even the best company will have a hard time increasing its earnings when the economy is in recession. Meanwhile, even a bottom-of-the-barrel company will be able to expand its profits in a booming economy.

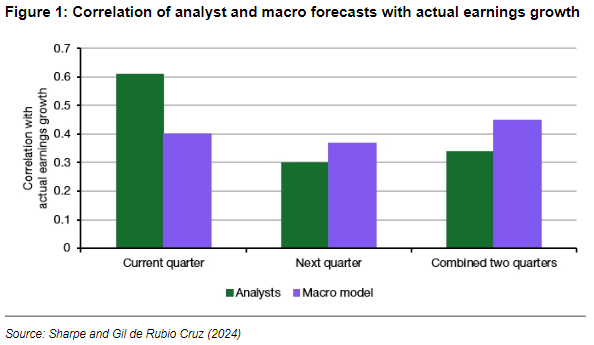

To check if macro forecasts can improve analysts’ earnings forecasts, the study authors built a very simple model that relies on GDP and USD exchange rate consensus forecasts for the current and the next quarter. They then looked at the correlation between the analysts’ forecasts and actual earnings growth, as well as the model forecast with actual earnings growth.

The results are interesting insofar as analyst forecasts have a higher correlation than the macro model with current quarter earnings growth, but when it comes to forecasts for the next quarter, the macro model outperforms the analysts. Putting both quarters together, the macro model also outperformed the analysts’ forecasts. This points to analysts’ understanding the current business environment, but then making the mistake of extrapolating this into the future. The fact that the macro model is better at forecasting two consecutive quarters indicates that analyst forecast errors compound over time, while the macro model forecast errors tend to cancel each other out over time.

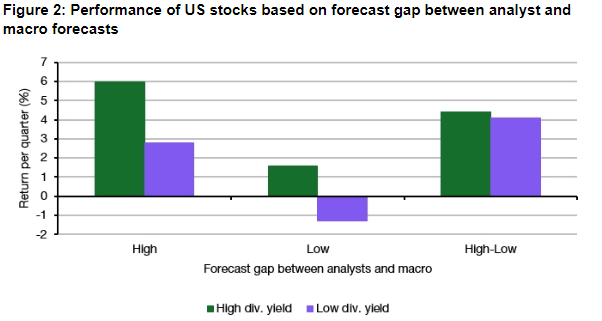

If there is a systematic forecast error in analyst forecasts that compounds over time, one could potentially exploit analyst forecast errors with the help of the macro model. The study tested a simple investment strategy that looked at the size of the gap between analyst forecasts and macro model forecasts for both high and low dividend yield stocks (don’t ask me why they decided to split the market into these two groups, but so be it). Indeed, companies where the macro model deviates by a large amount from analyst forecasts tend to have larger earnings surprises, and thus a stronger share price return, creating outperformance for investors.

In other words: If you are a fund manager, don’t just listen to equity analysts. You should meet more with strategists like me to discuss the overall market outlook and how the macro environment influences company earnings and stock markets.