Thought of the Week - Institutional investors don’t care about gold anymore

Let’s face it, gold has had another bad year. It started theyear at c.$1,900/oz. and is down more than 10% at the time of writing. And this was in a year when inflation rose dramatically in the United States and other countries. Whatever happened to gold as an inflation hedge?

I think there are many explanations for why gold prices have been so weak this year. One of them, in my opinion, is that many of the libertarian, “central banks are going to print money until we get hyperinflation”-types have moved on to cryptocurrencies where they think they have a currency for the 21st century that cannot be influenced by governments and central banks.

Another reason is that institutional investors just don’t seem to care about the yellow metal anymore. Back in 2004, when gold was at a relatively early stage of its decade-long rally, institutional investors accounted for c.20% of all holdings in gold ETF. That was such a small proportion that they hardly mattered for the gold price. By 2009, that had risen to c.40%, and institutional investors became one of the largest investor groups in the market. If they increased their gold holdings, they created enough flows to push gold prices higher and if they decreased their holdings, gold prices were likely to drop.

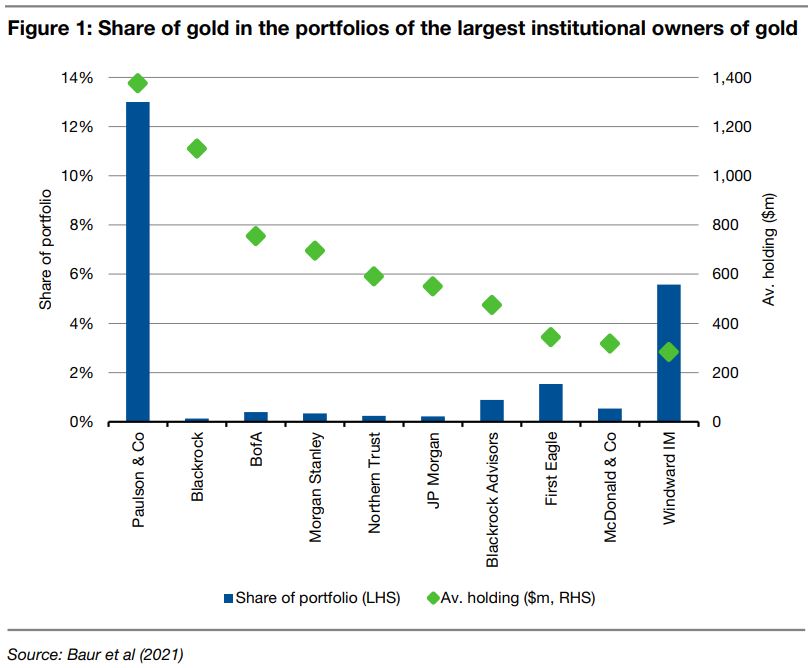

The problem is that, today, institutional investors still account for only 40% of total gold ETF holdings. After selling about a quarter of their holdings between 2011 and 2014, they bought again from 2014 to 2016 but only to pre-2011 levels. In most institutional portfolios, gold is either non-existent (e.g. Vanguard, DFA, Berkshire Hathaway) or such a small allocation that it scarcely warrants attention. The table below, taken from research by a group of Australian researchers, shows that the institutions that hold the largest amount of gold ETFs typically hold less than 1% of their AUM in gold. And in these cases, the gold holdings are part of a specialised portfolio or a dedicated gold fund. Unlike 10, 15 years ago, gold has become a sideshow again, as was the case throughout the 1980s and 1990s. And as long as that doesn’t change, there is little chance that gold will embark on another multiyear bull run.

Thought of the Week features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.